How a Lifetime Financial Plan Can Help Secure Your Future

How a Lifetime Financial Plan Can Help Secure Your Future

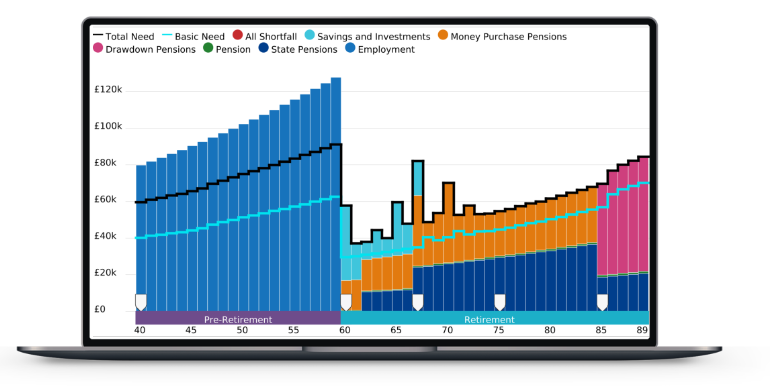

In an ever-changing financial landscape, having a clear understanding of your future income and expenses is essential. One of the most effective tools available to help with this is a lifetime financial plan. This type of plan provides a detailed projection of your finances over time, helping you make informed decisions today that will shape a secure financial future.

What Is a Lifetime Financial Plan?

A Lifetime Financial Plan is essentially a map of your financial life, from the present day to retirement and beyond. It takes into account all sources of income, such as salary, pensions, and investments, alongside all of your projected expenses, including living costs, taxes, and major life events like purchasing a home, paying for education, or planning for long-term care. A lifetime financial plan extends this view over the course of your life, helping to ensure you’ll have sufficient resources to meet your needs at every stage.

Why Is It Important?

- Gives You a Holistic View of Your Finances

A lifetime financial plan consolidates all aspects of your financial life, giving you a comprehensive overview. This helps ensure nothing is overlooked, whether it's a planned investment or an unexpected expense. By understanding how every financial decision impacts your overall plan, you can take control of your financial future.

- Helps You Plan for Major Life Events

Life is full of uncertainties. Major life events such as buying a home, starting a family, or retiring require significant financial resources. With a lifetime financial plan, you can simulate different scenarios and their financial impact. This allows you to plan proactively and make sure you have enough resources when those big events arrive.

- Manages the Risk of Running Out of Money

A key benefit of lifetime financial planning is the ability to test various scenarios to ensure your money lasts. By forecasting income and expenses over a long period, you can identify potential risks, such as outliving your savings, and take steps to mitigate them. This forward-thinking approach ensures your financial security in retirement and beyond.

- Optimizes Your Retirement Planning

For many, ensuring a comfortable retirement is a top priority. A lifetime financial plan gives you insight into how much you need to save, how investments will grow, and when it’s safe to start drawing from your retirement funds. It also accounts for changes in income sources, such as state pensions, and allows you to structure withdrawals in the most tax-efficient manner.

- Allows for Adjustments Along the Way

One of the most powerful aspects of a lifetime financial plan is that it’s dynamic and flexible. As life evolves, so too can your financial plan. You can revisit it regularly and make adjustments as circumstances change, whether it's due to a shift in income, unexpected expenses, or changes in your goals. This adaptability ensures your plan stays relevant and effective.

How a Financial Adviser Can Help

Creating an accurate and effective lifetime financial plan requires expertise. A financial adviser can work with you to gather all the necessary information, set realistic goals, and project the future impact of your decisions. They can also regularly review your plan and provide professional advice on investments, tax planning, and retirement strategies to ensure your plan stays on track.

In Conclusion

A cashflow and lifetime financial plan is more than just a spreadsheet – it’s a tool that empowers you to take control of your financial future with confidence. By providing a clear picture of your financial situation, both now and in the years to come, it helps you plan for major life events, protect against risks, and make informed decisions that align with your long-term goals. For anyone seeking financial clarity and peace of mind, it’s an essential component of a well-rounded financial strategy.

Contact us and quote “Lifetime Financial Plan” to arrange a free initial consultation with one of our Independent Financial Advisers to discuss how a lifetime financial plan could help you.

- Call us on 0208 603 3700,

- email [email protected]

- or [email protected]

Goddard Perry Consulting is a firm of independent financial advisers specialising in providing financial planning advice and business solutions.

Labour’s new Employment Rights Bill: challenges employers...

More Articles

The Value of a Sustainability Strategy in the Tender Process

Unlocking the Power of Raw Financial Data

Would you like to promote an article ?

Post articles and opinions on Professionals UK

to attract new clients and referrals. Feature in newsletters.

Join for free today and upload your articles for new contacts to read and enquire further.